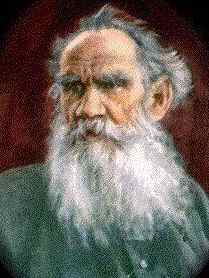

Iftikar Ahmed and his wife, Shalini, in 2012. He is a fugitive and believed to be in India. Photo: No credit

[From article]

A boyish 43 years old, Iftikar Ahmed ticked every box of the immigrant success story, going from Harvard Business School to Goldman Sachs Group Inc. and then landing as a partner at one of the oldest venture-capital firms in the country. He and his wife owned a mansion in Greenwich, Conn., and two apartments on Park Avenue in Manhattan, and gave large sums to local and Indian charities.

Yet before Mr. Ahmed fled the U.S. in May, he allegedly stole $65 million through a series of frauds that prosecutors and regulators said became increasingly brazen over the years and that exploited the trust-based culture of the venture-capital firm, Oak Investment Partners. Regulators said Mr. Ahmed began to commit fraud within months of joining Oak in 2004.

[. . .]

In December, Mr. Ahmed persuaded fellow Oak partners they should pay $20 million for a $2 million stake in a Hong Kong-based online retailer, pocketing the $18 million difference, the government alleged.

[. . .]

Oak executives later testified that they didn’t learn of the actual $2 million sale price until after Mr. Ahmed’s arrest, even though the seller disclosed it in a news release, according to court filings and people familiar with the matter. Oak executives said they also found Mr. Ahmed had massaged financial projections for the Hong Kong company, adding a “1” in front of the revenue figure, to make its sales appear far healthier than they were, according to court documents.

[. . .]

After Mr. Ahmed was arrested in May on federal insider-trading charges, he surrendered U.S. and Indian passports, according to court records. In May, he fled the country using an expired passport, according to court documents. He is now a fugitive. Mr. Ahmed couldn’t be reached for comment.

Mr. Ahmed is believed to be in India, according to his lawyer, Alex Lipman. The former executive needs authorities’ permission to leave India, after being held in prison for 61 days until July 23 for allegedly entering the country illegally, Mr. Lipman said. He faces a prison sentence of up to 20 years in the U.S. if convicted of insider trading.[. . .]

A spokesman for Oak Management Corp., which operates as Oak Investment Partners, said in a statement an internal probe had found Mr. Ahmed was a “rogue employee” who repeatedly circumvented the firm’s policies and procedures.[. . .]

Born in India, Mr. Ahmed graduated from the elite Indian Institute of Technology in New Delhi before getting an M.B.A. degree from Harvard Business School. He and his wife, Shalini Ahmed, were prominent figures in Connecticut’s close-knit and wealthy Indian-American community.

According to court testimony in the SEC case, Mrs. Ahmed said she met her husband in 1999 when he was working at Goldman Sachs in a group that invested money on behalf of the firm. She told the court that when she heard the allegations against Mr. Ahmed: “I was shocked. I was stunned. That was not my husband.”

[. . .]

Mr. Ahmed used fake invoices for frauds totaling more than $20 million involving at least four companies, according to the SEC.

[. . .]

In April 2013, Mr. Ahmed was diagnosed with cancer following an operation, according to court testimony from his wife, who didn’t give any details of the illness.

[. . .]

Meanwhile, Mr. Ahmed’s wife is fighting criminal charges of money laundering filed against her and her husband in August tied to the alleged frauds. In the weeks after Mr. Ahmed was arrested on insider-trading charges, she completed the $8.6 million cash purchase of a Manhattan apartment and tried to transfer about $250,000 to India, prosecutors said. The fraud, insider-trading and money-laundering cases are continuing.

http://www.wsj.com/articles/harvard-goldman-sachs-venture-capitalfugitive-1444261176

Harvard, Goldman Sachs, Venture Capital…Fugitive

Iftikar Ahmed appeared to be an immigrant success story, but prosecutors and regulators allege he stole $65 million

By Anupreeta Das and Jean Eaglesham

Oct. 7, 2015 7:39 p.m. ET

No comments:

Post a Comment