May 28, 2014

Proposal To Eliminate Corporate Income Taxes

[From article]

the 35 percent U.S. corporate income tax.

Britain’s corporate income tax is 20 percent, and Pfizer stands to save over $1 billion a year by moving there.

In what are called “inversions,” dozens of U.S. companies have bought up foreign rivals, and then moved abroad to countries with lower tax rates, cutting revenue to the U.S. Treasury.

But Pfizer is far and away the biggest.

[. . .]

How could we make up for the lost revenue to government?

Simple. The corporate income tax last year produced $273 billion, less than a tenth of federal revenue. Imports, which kill U.S. jobs and subtract from GDP, totaled $2.7 trillion last year.

Put a 10 percent tariff on imports, and the abolition of the U.S. corporate income tax becomes a revenue-neutral proposal.

[. . .]

Two decades ago, Ross Perot and this writer joined Ralph and the head of the AFL-CIO to stop NAFTA, a trade deal backed by America’s corporate elite and its army of mercenaries on Capitol Hill.

Congress voted with corporate America — against the country.

Result: 20 years of the largest trade deficits in U.S. history. Transnational corporations have prospered beyond the dreams of avarice, as Middle America has seen its wages frozen for a generation.

[. . .]

For America never voted for NAFTA, GATT, the WTO, mass immigration, amnesty, or more H-1Bs to come take the jobs of our workers. These votes have been forced upon members of Congress by leaders carrying out their assignments from corporate America and its PACs, which reward the compliant with campaign checks.

Both parties now feed at the same K Street and Wall Street troughs. Both have oligarchs contributing tens of millions to parties and politicians who do their bidding.

http://buchanan.org/blog/abolish-corporate-income-tax-6399

Abolish the Corporate Income Tax!

Tuesday - May 13, 2014 at 1:17 am

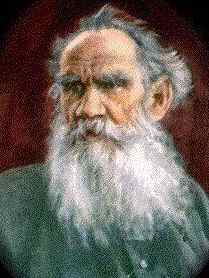

Pat Buchanan

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment