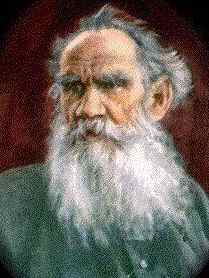

Pei-Shen Qian said he was “stunned” so many people were fooled by his work.

[From article]

At $8.3 million, it was the most expensive painting that the De Soles — the chairman of Tom Ford International and his socialite wife — had ever purchased, but they were getting what one source calls “a pretty sweet deal.” Weeks before the sale closed, a work by Rothko sold for $17,368,000 at Sotheby’s. Knoedler drew up a warranty of “authenticity and good value,” and the De Soles proudly hung Rothko’s “Untitled 1956” inside their luxurious Hilton Head, SC, home.

That was in November 2004. Come 2011, Domenico De Sole had new feelings about the artwork — ones that, a friend speculates, might have prompted him to yank the painting off the wall in frustration.

The Rothko had been forged. The heir never existed. And the De Soles weren’t alone as victims of deception.

From 1994 until 2009, Knoedler & Co. admittedly — but, the claim goes, unknowingly — sold 31 other bogus paintings. Through those sales, the gallery raked in some $80 million. Luke Nikas, Freedman’s lawyer, says that she earned $10- to $12-million between 1994 and 2008. Moguls and megalevel tastemakers all thought they were buying works by such abstract expressionist blue-chippers as Jackson Pollock, Robert Motherwell and Willem de Kooning.

The scandal brought down Knoedler, which closed its doors in November 2011.

Starting Monday in US District Court, a trial will examine whether Freedman, Knoedler and the gallery’s owner, 8-31 Holdings knew that the De Soles’ Rothko was a fake.

“Art frauds, forgeries and fakes comprise most of the art-crime world, which takes in $6 billion annually,” Robert Wittman, former senior investigator with the FBI’s art crime teams, tells The Post.

[. . .]

other art-world heavies opted to keep things quiet and turn blind eyes to the deception. “If you have a collection worth $50 million,” he says, “you don’t want one painting to tarnish the authenticity of all the others.”

[. . .]

Curators from the National Gallery of Art and the Guggenheim Museum were fooled as well; in the latter case, a Rosales fraud was borrowed for an exhibition.

As the trial nears, a few facts are certain. Rosales sold fraudulent art; after pleading guilty to nine counts that include wire fraud and money laundering, she agreed to cooperate in the investigation and is awaiting sentencing. Her boyfriend Bergantiñoswas arrested in Spain and remains there. Pei-Shen, who brilliantly forged work by the most lauded artists of the 20th century, is on the loose and untouchable somewhere in China.

[. . .]

In terms of how this was able to go on for so long, Judd Grossman, an attorney who specializes in art cases, chalks it up to the industry’s dark corners. “Unlike any other market where large sums of money change hands, the art market is unregulated,” he says. “It’s easier to perpetrate a scheme that is fraudulent or barely walks the line.

“Knoedler wasn’t the first such scandal, and it won’t be the last.”

http://nypost.com/2016/01/24/inside-the-80m-scam-that-rocked-the-art-world-and-hits-courts-this-week/

Inside the $80M scam that rocked the art world and hits courts this week

By Michael Kaplan

New York Post

January 24, 2016 | 4:04pm

No comments:

Post a Comment