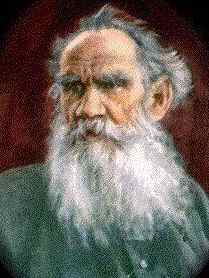

Cash inventory: Jeff Hirsch, one of three brothers who own Bi-County Distributors on Long Island is still out $446,000 as the government sits on the company's cash and won't explain why

[From article]

The federal government is using a legal process called 'civil forfeiture' to seize massive amounts of money from unsuspecting Americans – without alleging that they've committed any crimes.

Laws put on the books to help the government track drug trafficking proceeds and terrorists' cash reserves are regularly contorted, according to a civil rights group, by prosecutors who see easy access to piles of cash that ultimately pays their salaries.

The financial seizures leave some honest small businessmen and women out of luck when their life savings disappear and their family trades teeter on the edge of insolvency.

In one case, the IRS took $446,000 from a mostly cash-only small business that distributes candy, snacks and cigarettes to convenience stores. Brothers Jeffrey, Richard and Mitch Hirsch lost that money two years ago when the federal government raided their bank account.

In another, the government grabbed $33,000 from Iowa restaurateur Carole Hinders, who deals only in cash. No criminal charges have been brought in either case.

[. . .]

Equally troubling, he said, is that the laundry list of federal agencies that take Americans' property on a regular basis can keep it – pocketing cash and selling other assets – in order to pay salaries and grow their budgets for the next round of seizures.

While they ultimately refer criminal cases to the U.S. Department of Justice for prosecution, forfeited assets stay with the investigating agencies.

[. . .]

In the Hirsches' case, the government never formally applied to a court for permission to take their cash. That's a clear violation of the Civil Asset Forfeiture Reform Act, the Institute for Justice says.

Congress passed that law in 2000 to curb abuses by prosecutors under forfeiture laws.

[. . .]

'The government can take this money and just sit on it, and try to force you into a settlement. Which is what they've done in this case and in others.'

In the Iowa case, the Times reported Monday that Hinders got a knock on her door last year from two federal agents who told her that her checking account had been seized.

'How can this happen?' she asked the Times. 'Who takes your money before they prove that you've done anything wrong with it?'

Hinders won't see a judge until at least May 2015, since she's not entitled to a preliminary hearing where a judge might conclude the IRS had no justification to take her earnings.

'We're just saying the government should have to show it has probable cause to hold that money,' Salzman said. 'Why not give a prompt post-seizure hearing to make sure the government doesn't have the facts wrong?'

http://www.dailymail.co.uk/news/article-2809632/IRS-uses-drug-trafficking-terror-laws-seize-bank-accounts-taxpayers-without-proof-crime.html

IRS uses drug trafficking and terror laws to seize bank accounts from taxpayers without ANY proof of a crime

Agencies that seize the cash can KEEP IT to pay salaries and grow their budgets

Feds seized $446,000 from NY candy and cigarette distributor that deals mostly in cash;Iowa grandma lost $33,000 from her restaurant business

Government can take money if it thinks people are evading financial reporting laws by depositing money in specific amounts

Deposits of $10,000 or more trigger bank reporting requirements, so drug kingpins, terrorists and racketeers often limit their deposits to $9,900

Law-abiding people can have their money seized; IRS can sit on the cash and try to pressure ordinary businessmen and women into settlements

Institute for Justice, a nonprofit law firm, is pushing back and demanding hearings before federal judges

By DAVID MARTOSKO, US POLITICAL EDITOR FOR MAILONLINE

PUBLISHED: 13:09 EST, 27 October 2014 | UPDATED: 15:18 EST, 27 October 2014

No comments:

Post a Comment